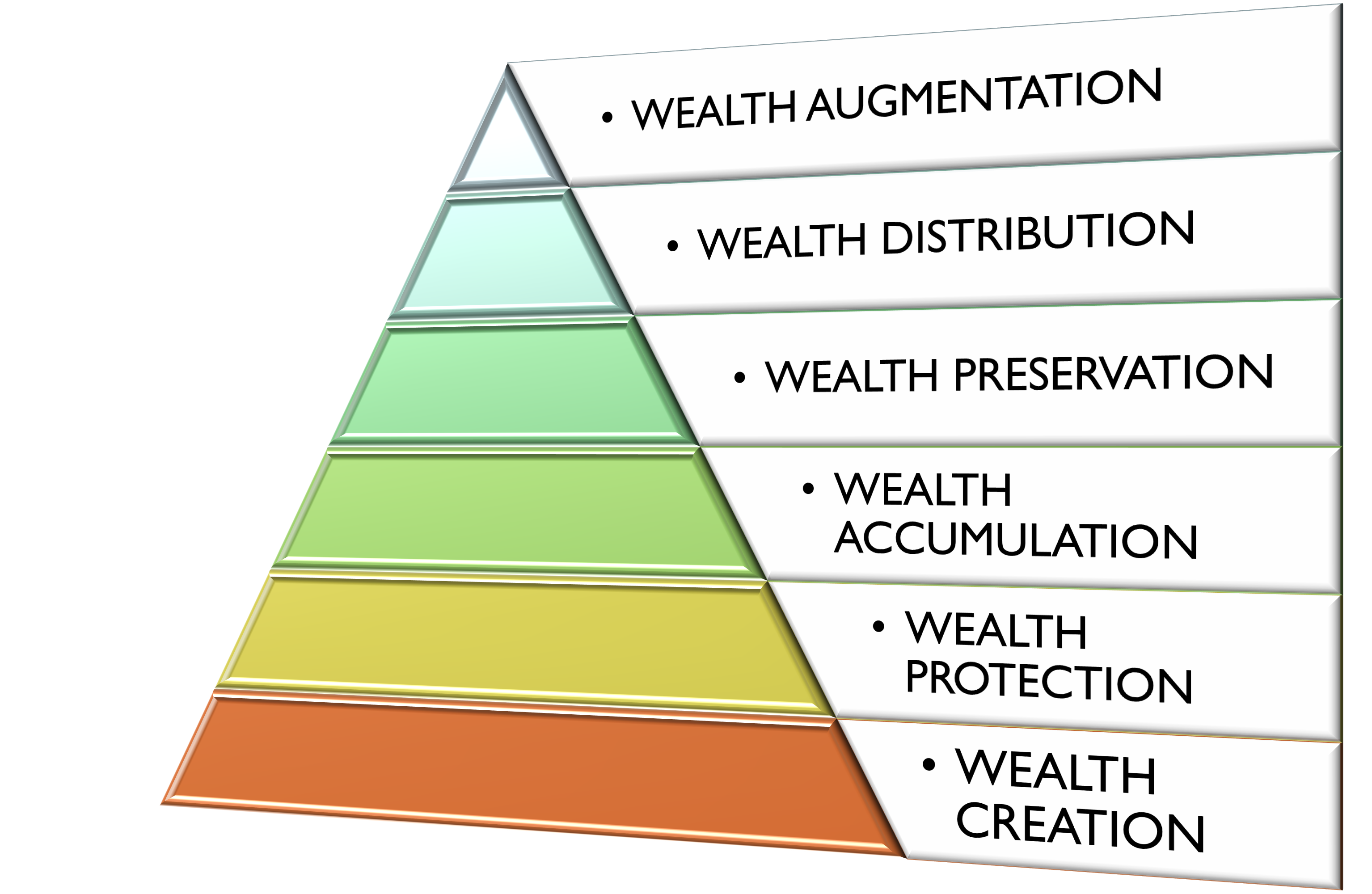

Wealth Pyramid

In all stages of our lives, we go thru what we call a Wealth Pyramid. And it is important to note that at each stage of the pyramid, the needs and requirements are different hence the tools needed are different as well.

I help my clients thru each stage of their lives and bringing them step-by-step to the next stage by leveraging on tools that can help them achieve this result.

Nicholas Tan's QOTD

"It's not about having lots of money. It's knowing how to manage it."

The Wealth Pyramid

Our Life's Journey Financially

Wealth Creation

This is the process of making money through business or employment. At this stage, you want to make sure that you have certain skills to generate income more than your daily expenses and debts.

It is important to note that in the Wealth Creation stage, you will need to establish a stable and positive cash flow.

Wealth Protection

At this stage, we need to talk about the "safety net" that needs to be looked into. Life has many unfortunate incidents that can ruin our Wealth Creation plans if we do not look into Wealth Protection.

Here, insurance is a must for protecting your income. Major sickness or unwanted events could put you in a position where you are unable to work for your income hence destroying all your efforts in creating your wealth.

Protection tools such as Medical Card, Critical Illness, Accidental Death or Total Permanent Disablement & Personal Accident are crucial for this planning.

Wealth Accumulation/Appreciation

Once you are well protected, you can start to work on accumulating wealth. Grow your financial portfolios through investments like unit trust, shares, properties and certain managed funds.

Make sure you don't over leverage and end up paying interest more than earnings. Its all about making wise decisions, getting the knowledge and experiences in financial planning and not to invest by "following the crowd."

Wealth Preservation

What you need to do here is to make sure that your overall earnings can be preserved and is risk-free. Use saving vehicles that provides higher returns than conventional bank savings yet are 100% secured and provides good risk protection as well as protection during unfortunate events.

The target here is to beat inflation and have your capital protected in a secured vehicle. Work on retirement savings at this stage so you know what your end game is like.

Wealth Distribution

Over here, you will need to start thinking about distributing your wealth after you're no longer around. Start Legacy Planning for the next generation.

Other areas of planning include Tax Planning, Business Continuity Planning (for business owners) & Charitable Planning (using Trust and Foundations).

This is also where you explore ways to fund all your distribution methods using financial tools available in the market.

Wealth Augmentation

The only real method is to leverage on huge amounts of life insurance sum assured. All of the richest people in the world will put in a lot of money into insurance because they know that it is the main tool that can augment their wealth to the next level.

Li Ka Shing - Richest Man in Hong Kong

So long as you are born a Li family, you will be insured with $100 million.

No matter what happens, Li Ka Shing will ensure everyone in his family gets $100 million.

He says, "Everyone says I am rich but actually my real wealth and assets that belongs to me is in buying insurance."

Worth To Think...

An umbrella sold at RM5; people say expensive. On a rainy day, even at RM30 it will be sold out.

Buying an insurance policy at RM6k a year; people say expensive. But when you get critical illnesses, you would need to spend easily RM200k and may need to sell your car or house to sustain your living expenses.

People would rather not buy insurance and spend RM200k to solve a RM200k problem. If they had bought insurance, they only need to spend RM6k to solve a RM200k problem.

If I spend 30 mins to explain all these to you, it will take you 3 mins to reject me. But the doctor only need to spend 3 mins to tell you your medical situation and you would need to spend 30 years of your hard earned savings.

Nicholas tan

"Insurance is to protect your ability to earn money and to protect your ability to hold onto the money that you have earned."

RSVP

♥

Let me help you in your financial journey.

Built by The Website Asia